Contents

Scalping is a trading strategy that attempts to profit from multiple small price changes. Scalping strategies work best when strongly trending or strongly range-bound action controls the intraday tape; they don’t work so well during periods of conflict or confusion. Scalpers can meet the challenge of this era with three technical indicators that are custom-tuned for short-term opportunities. Our strategy takes advantage of this pullback before the price action continues upward in this example. It is an exceptionally perplexing device for everyday trade.

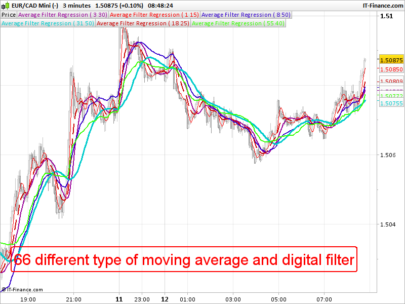

A scalper will have many positions open at any given time, each with very small profit potentials. The idea behind this strategy is to make several small profits instead of one large one, which can be offset by any losses you incur from other trades or from market fluctuations. The Exponential Moving Average or EMA indicator is another useful indicator that enables traders to give more weightage to recent prices, while SMA assigns equal weightage to all values. The EMA indicator is regarded as one of the best indicators for scalping since it responds more quickly to recent price changes than to older price changes.

However, there are still brokers who allow scalping so it is better to ask them first. Take note that a scalper should choose a broker who has the lowest trading spreads and has no restrictions. A good broker also needs to provide fast price feeds due to the fast-paced environment of scalping. Futures and Options trading carries high risks as well as high rewards. You must be aware and willing to accept the risks to invest in the markets. Past performance of any results does not guarantee future performance.

The Best scalping indicators

No more of those indicators that only confuses traders and adds to the delay of making a decision. Trend trading on the other hand requires the trader to execute a few trades to try and catch the trend for the day. Quick profits will always be a trader’s dream, especially for beginners with small deposits. It is psychologically difficult to wait for the completion of the transaction for several hours or days, open in small lots and increase the deposit in small portions. An obsession arises to put the maximum leverage, switch to lower timeframes, and start using scalping techniques. Use these indicators so that your scalping strategy is based on relatively accurate indicators.

Switch to the 5-minute chart of the euro/dollar currency pair, changing the turn parameter from 3 to 5. As you can see, the line forecasting the price change has become smoother. After the market moves to the profitable zone, it is necessary to transfer the transaction to breakeven, which will allow not to lose the already earned. The RSI is another popular oscillator that is used mostly to identify overbought and oversold levels in the market. The rest of the way, you can use this indicator as you would use any other moving average indicator.

But when the bearish arrow falls below the most recent bearish arrow, you may trade the market as if in a downtrend. Despite the sophistication of this indicator, it is best to use it with accurate price action knowledge. But price action helps you add more details to your analysis, hence reducing your risks.

This scalping indicator by ‘Trend Following Systems’ can be used on all currency pairs and time frames. If you do not yet have the correct MT4 / MT5 charts to use these scalping indicators, make sure you read about the best trading charts and the broker to use these indicators with here. However, these indicators are not just useful for scalpers. Without a doubt, intraday traders and swing traders can easily benefit from those indicators. The momentum indicator has a signal line that oscillates between a range of 110 and -110 on the vertical side of the indicator window on your MT4. It then uses two other lines to denote the 50 and -50 levels.

Range Filter Buy and Sell 5min Strategy (MT4 & MT

The term “scalping” refers to a form of trading where traders try to make money off tiny price fluctuations, usually after having executed an order and gaining profit. This is different from what other day traders do, who begin from a hourly to a 30-minute and then to a 15-minute chart. Whilst these indicators will often give you quality buy and sell signals that are easy to decipher and then execute, you can often enhance their probability.

This multifaceted nature of the RSX indicator is ultimately what makes it one of the best indicators for scalping. The TTM Scalper indicator works on all timeframes and currency pairs on the MT4. But the lower timeframes are where the indicator recorded its highest success rate when we tested it out.

Moving Average

There is a specific formula that you should be aware of to determine the MACD. You need to figure out the 26-day Exponential Moving Average and subtract that for the 12-day EMA. The Average Convergence Divergence Indicator is an advanced tool capable of delivering high-end data for Scalping strategies. Even though this is a multipurpose tool, you can use it to build a sound Scalping strategy.

- With these, you can easily filter out your trades so that you are only left with medium to high probability trades.

- Potential buy trades are when the line moves higher above the zero level.

- This simplicity allows scalpers to jump on short-term positions as suggested by the indicator with ease.

- However, what makes the Laguerre filter indicator peculiar is the different perspective it gives to your trading, which is unlike what all the moving averages offer.

The Best Scalping indicator is a simple trend indicator that gives you buy and sell signals using blue and red arrows on any currency pair. The blue, upward-facing arrow denotes a buy while the red, downward-facing arrow tells you to sell. However, discipline and patience is highly needed for this trading strategy.

Parabolic SAR indicator

Alan received his bachelor’s in psychology from the University of Pittsburgh and is the author of The Master Swing Trader. Because scalping is driven by technical analysis, you should consider using other technical indicators as well. So in this analysis step to the strategy you need to check out the volume indicator. Based on what you now know, make a good trading decision based on the current price action.

And so we dedicate this piece to all scalpers, novice and expert, who need a shortlist of the best MT4 indicators for scalping. So go for it and get the all what you want but first learn the all skill that is the part of the scalping indicators. QFL stands for Quickfingersluc, what are the consequences of overdrawing your checking account and sometimes it is referred to as the Base Strategy or Mean Reversals. Its main idea is about identifying the moment of panic selling and buying below the base level and utilizing Safety orders. Base level or Support Level refers to the lowest price level that…

The SM Buy Sell Pressure indicator is a momentum indicator that effectively predicts overbought and oversold price levels in forex. And it doesn’t just do that, it also offers signal arrows that help you know when to buy and when to sell. For instance, some indicators are for trend trading, while others are for reversals. You’ll also find those that help you determine market volumes and volatility. As a result, a novice trader who doesn’t already know all the trading tools they need may find it even harder to pick and use these indicators rightly. Even if trading is a hobby or a full-time job, it still pays to learn more about it.

This indicator likewise sends notices and cautions to the email that you have utilized in this indicator. The infinity scalper indicator is an indicator that is utilized for scalping. The infinity scalper indicator is created by Karl Dittman.

Second,high-frequency trading now dominates intraday transactions, generating wildly fluctuating data that undermines market depth interpretation. Finally, the majority of trades now take place away from the exchanges in dark pools that don’t report in real-time. https://1investing.in/ The volume indicator could be interpreted as the “fuel tank of the major trading machine.” Some argue that the volume indicator cannot be used with trading in the forex market. This is because there is no “central exchange” so how can it be read effectively?

Finally restart the MT4 platform and attach the indicator to any chart. Additionally, the indicator can be used together with any strategy or system of your preference. Hi , I would like to Lear scalping options , do you have any training session on the strategy . Tap on the E-Book Cover Below to get your copy of this Free strategy today.

This indicator is created with the most progressive and new highlights. It tends to be utilized in unsurpassed meetings like Tokyo time meeting, New York Times meeting, and London time session. This boundary of the indicator causes the dealers to recognize the patterns by explicit periods. This boundary empowers the dealers to recognize the changes in the market pattern. The Quantix scalper indicator additionally has a stop misfortune technique that disposes of the odds of dangers in the market pattern.

When you have a long position open, you want to see a rising MDX ALGO as it will help you close your position with a profit at around the same time or even earlier than expected. Since this is a brand new trend and it is not an unreal movement, it is possible for traders to be above the trend in its initial stages if they are able to follow the movement. In this article, we will explore this best scalping indicator. Trading with the best trading indicator is easy because you only need to follow the arrows to buy and sell.

You need to trade only at short time intervals to earn more money. Entrance signals are not very frequent, but up to transactions on one pair can go out per day. With a strong decrease in the indicator lines, relative to its past values, you need to look for points to buy, and with a significant increase – sales. It’s the latest accurate indicator, working at time intervals M1-M15. Not three lines of indicators are used here, but their correlating values.

Other types of moving averages like the Simple Moving Average , Smoothed Moving Average, and Volume Weighted Moving Average are used the same way in trend-following. Successful scalpers use different trading strategies in the market. For example, there are those who focus on trend-following while others aim to identify reversals.